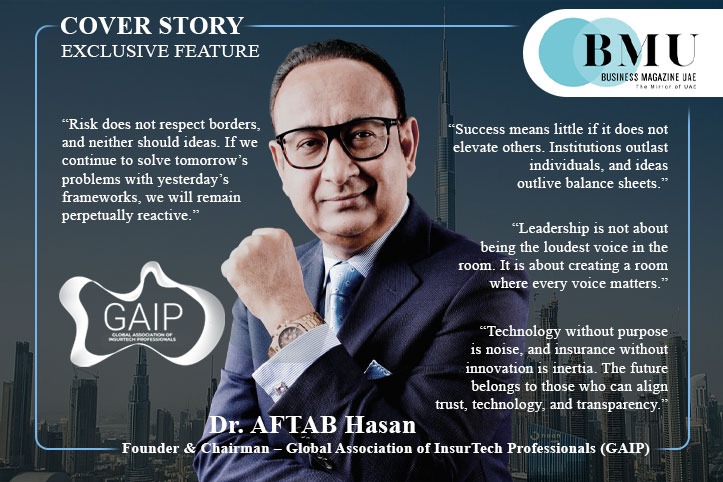

Founder & Chairman – Global Association of InsurTech Professionals (GAIP), Chairman – Risk Exchange (DIFC) Ltd., Chairman – A2R Solutions, CEO – Arya Insurance (Bayzat), and International Thought Leader, Author & Speaker.

Dr. AFTAB Hasan: The Architect of Convergence in a Fragmented World

In an era defined by geopolitical uncertainty, economic recalibration, climate volatility, and rapid technological disruption, leadership is no longer measured by scale alone, but by clarity of vision, courage of conviction, and the ability to unite disparate forces toward a common purpose. Few figures in the global insurance and InsurTech ecosystem embody this new archetype of leadership as distinctly as Dr. AFTAB Hasan.

Often described by peers as an analytical, out-of-the-box thinker, Dr. Hasan has never been content to inherit legacies or operate within well-worn institutional comfort zones. Instead, across more than three decades of professional engagement spanning insurance, reinsurance, technology, energy, infrastructure, and financial services, he has consistently chosen the more difficult path: building platforms where none existed, challenging conventions, and asking questions that others avoided.

Today, his influence extends far beyond the insurance sector. His following includes policymakers, technocrats, entrepreneurs, academics, regulators, and business leaders from multiple industries and geographies. This cross-sector resonance is not accidental; it is the result of a career shaped by diversity of experience, intellectual rigor, and an unwavering belief that industries grow stronger through collaboration rather than competition.

From Practitioner to Platform Builder

Dr. Hasan’s professional journey did not begin with grand titles or institutional patronage. It began with hands-on engagement, technical mastery, and an instinctive understanding of risk. Early in his career, he distinguished himself through his ability to combine granular underwriting insight with strategic foresight. While many in the industry focused narrowly on transactional brokerage, Dr. Hasan looked at insurance as a socio-economic stabilizer, a risk-transfer mechanism with profound implications for trade, infrastructure, and national resilience.

Over the years, he held leadership roles across multiple markets and disciplines, gaining exposure to complex risks in emerging and developed economies alike. This diversity of experience shaped his worldview. As he often remarked at conferences and interviews:

“Risk does not respect borders, and neither should ideas. If we continue to solve tomorrow’s problems with yesterday’s frameworks, we will remain perpetually reactive.”

This philosophy became the cornerstone of his entrepreneurial path. Rather than riding on institutional legacies, Dr. Hasan built his own. As a serial entrepreneur, he founded and scaled multiple ventures across insurance, reinsurance intermediation, technology solutions, and international advisory platforms. Each initiative carried a common thread: independence of thought, ethical clarity, and long-term value creation.

Leadership in a Time of Global Flux

The past decade has tested global systems like never before. The COVID-19 pandemic, supply chain shocks, inflationary pressures, geopolitical realignments, and accelerating climate risks have fundamentally altered how businesses perceive uncertainty. For Dr. Hasan, these disruptions were not merely crises but catalysts.

He emerged during this period as a thought leader who articulated what many in the industry sensed but struggled to define: that insurance and reinsurance were at an inflection point. Legacy models were insufficient. Fragmentation between insurers, reinsurers, technologists, and regulators was inhibiting innovation. InsurTech, despite its promise, was evolving in silos.

In one widely quoted address, he stated:

“Technology without purpose is noise, and insurance without innovation is inertia. The future belongs to those who can align trust, technology, and transparency.”

This clarity of thought positioned him as a leader par excellence, not because he commanded authority, but because he offered direction.

The Birth of a Bold Idea: GAIP

For over three decades, Dr. AFTAB Hasan has stood at the intersection of insurance, technology, and global economic leadership, shaping the future of how societies manage risk in an increasingly digital world. Today, as the Founder & Chairman of the Global Association of InsurTech Professionals (GAIP), he leads one of the world’s most influential non-profit organizations dedicated to uniting the insurance and technology sectors under a shared vision: collaboration over competition, innovation above convention, and resilience beyond borders.

The global InsurTech market, currently valued between USD 16–20 billion is projected to reach USD 60–80 billion by 2030, reshaping customer experience, underwriting, claims management, parametric risk solutions, AI-driven analytics, and digital distribution models. At the nucleus of this transformation stands Dr. Hasan, with GAIP rapidly emerging as the world’s first unified platform for global InsurTech professionals.

His journey from conceptualizing GAIP during the post-pandemic phase to presenting white papers at the United Nations in Geneva, and engaging with governments, regulators, and diplomatic missions worldwide reflects an unwavering commitment to building a safer, smarter, digitally connected insurance ecosystem for future generations.

Among Dr. Hasan’s many initiatives, none has captured global attention quite like the Global Association of InsurTech Professionals (GAIP).

GAIP was not conceived in a boardroom backed by institutional capital. It began as a conviction. Dr. Hasan recognized that while InsurTech was rapidly growing, the ecosystem itself was fragmented geographically, culturally, and philosophically. Start-ups, insurers, reinsurers, regulators, and investors were often speaking different languages, pursuing parallel goals without alignment.

His idea was both simple and radical: create a neutral, non-profit, global platform that would bring the entire InsurTech ecosystem together under one umbrella, driven not by commercial interests but by shared purpose.

As he articulated during the early days of GAIP:

“No one alone is smarter than all of us. Progress happens when competition gives way to collaboration.”

Starting alone, Dr. Hasan laid the foundation for GAIP with a clear governance philosophy: inclusivity, consensus-building, and respect for diverse viewpoints. He deliberately avoided positioning GAIP as a personality-driven organization, even as his own credibility attracted attention. Instead, he focused on building trust.

THE RISE OF GAIP: FROM CONCEPT TO GLOBAL REALITY

A Post-Pandemic Vision That Became a Global Movement

The COVID-19 crisis exposed a truth the world could no longer ignore:

traditional insurance models were not built for digital disruption or systemic shocks.

During this period, Dr. Hasan envisioned GAIP, an international platform that would:

- empower professionals with knowledge, certifications, and global standards

- accelerate digital transformation through InsurTech innovation

- foster collaboration between insurers, reinsurers, regulators, and technology leaders

- promote research, policy frameworks, and benchmarking studies

- strengthen global resilience in an era marked by climate risks, pandemics, and cyber threats

This vision quickly gained global acceptance. After presenting his white paper in Geneva and engaging with international organizations, GAIP evolved from an idea into a multi-continental movement.

GLOBAL FOOTPRINT: GAIP CHAPTERS ACROSS WORLD INSURTECH HUBS

Within months of its establishment, GAIP began expanding across continents. Today, GAIP has chapters launched or under approval in leading global InsurTech hubs, including:

| Australia | Mozambique |

| Brazil | Saudi Arabia |

| China | Singapore |

| France | South Africa |

| Germany | Switzerland |

| Hong Kong | Turkey |

| India | United Arab Emirates |

| Japan | United Kingdom |

| Kenya | United States |

These hubs represent the world’s most innovative insurance ecosystems; supported by regulatory sandboxes, venture capital accelerators, and tech-driven insurers reinventing risk models.

GAIP’s purpose in each of these markets is clear: enable connectivity, foster innovation, and build a global community for the digital insurance future.

From One Voice to a Global Chorus

What followed surprised even seasoned observers of the industry.

Within a short span, professionals from across continents rallied behind GAIP. Industry leaders, regulators, technologists, academics, and young entrepreneurs found in GAIP a platform that listened before it led. Chapters began to take shape across the Middle East, South Asia, Europe, and beyond, each adapted to local realities while aligned with a shared global vision.

Dr. Hasan’s leadership style played a decisive role in this expansion. Known for his magnetic charisma, he brought people together without confusion, dispute, or ambiguity. He insisted on consensus, encouraged debate, and gave credit generously. Those drawn to GAIP often spoke of a rare quality: clarity without arrogance.

In interviews, he frequently emphasized:

“Leadership is not about being the loudest voice in the room. It is about creating a room where every voice matters.”

This approach transformed GAIP from an idea into a movement. Today, it stands as one of the few truly global, non-profit InsurTech associations with a growing footprint across multiple geographies and cultures.

Respect Across Industries and Generations

What distinguishes Dr. Hasan is not merely his institutional achievements, but the breadth of respect he commands. His fan following extends beyond insurance and InsurTech into trade bodies, chambers of commerce, economic forums, and academic circles. He is as comfortable moderating high-level policy discussions as he is mentoring young entrepreneurs.

This resonance stems from authenticity. Colleagues describe him as passionate yet pragmatic, innovative yet grounded, ambitious yet deeply ethical. He has surprised peers repeatedly not with theatrics, but with ideas that are both noble and executable.

In one broadcast interview, reflecting on his journey, he remarked:

“Success means little if it does not elevate others. Institutions outlast individuals, and ideas outlive balance sheets.”

The Road Ahead

As GAIP continues its global expansion, Dr. Hasan remains focused on the long term. His vision extends beyond conferences and chapters to education, policy advocacy, innovation labs, and talent development. In a world grappling with systemic risk, he sees InsurTech not as a niche, but as a critical enabler of economic resilience.

Against the backdrop of global uncertainty, Dr. AFTAB Hasan represents a different kind of leadership. One that is self-made rather than inherited. One that unites rather than divides. And one that proves that in the most complex of industries, clarity of purpose remains the most powerful force of all.

In redefining collaboration for the insurance and InsurTech world, he has not merely created platforms. He has created belief.

Also Read:

The Tourist Sector in The UAE Will Maintain its Strong Upward Trend in 2025

NASA’s Maven Mars Probe Loses Communication