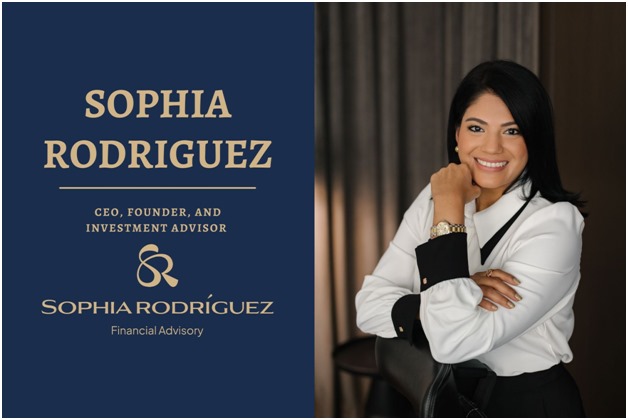

We recently had the privilege of interviewing Sophia Rodriguez, CEO, Founder, and Investment Advisor of Sophia Rodriguez Financial Advisory. With a mission to provide top-notch financial advice, Sophia’s organization specializes in creating personalized financial solutions, generating sustainable results, and helping clients build a strong financial future. Spanning from retirement planning, personalized financial management, and real estate investments, to financial education and employee wellness, Sophia and her team are committed to transforming financial goals into tangible achievements for their clients.

The Beginning

We started the interview by asking, “How did you get started, and what led you to where you are today?”

Sophia Rodriguez shared, “In 2016, I founded Finanzas con Sophia with a clear purpose: to help professionals across Latin America achieve financial security through personalized financial planning and tailored investment strategies. It all started after a life-changing moment—being laid off from what I considered my dream job. Instead of seeing it as a setback, I saw it as an opportunity to pursue my true passion: helping people transform their financial lives.

I started by offering one-on-one financial coaching from my home office, driven by a deep belief that financial freedom is achievable with the right guidance. What began as individual sessions soon grew into a thriving online community, where clients not only entrusted us with their finances but also shared their dreams and long-term goals, creating meaningful and lasting relationships.

As our vision grew beyond borders, we evolved into Sophia Rodriguez Financial Advisory, now headquartered in Dubai, UAE. Today, we serve clients globally, combining personalized advisory services with innovative financial solutions—all while staying true to our core mission: empowering people to live with financial confidence and security.”

A Strategic Ally

We were interested to learn more about the role Sophia Rodriguez plays at her organization. So, we asked, “Can you share more about your current role and the business you lead? What are the core services/products you provide?”

Sophia Rodriguez shared, “As the founder and CEO of Sophia Rodriguez Financial Advisory, I see my role as much more than managing finances—I become a strategic ally in my clients’ most important life goals. Whether it’s building wealth, planning for retirement, or securing their children’s future, I design personalized financial strategies that align with their unique aspirations and long-term vision.

I offer personalized financial planning and investment advisory services, specializing in retirement planning, financial management, and investment portfolio development. In addition, I provide tailored financial education through workshops and one-on-one advisory sessions, helping individuals and teams develop lasting financial literacy and make confident decisions about their futures.”

“To ensure the best client experience, I lead an international team of financial advisors based in countries like Costa Rica, Colombia, Venezuela, Spain, and the UAE. My operational team supports key processes such as client onboarding, customer service, and administrative management, enabling me to focus on what I do best—providing personalized, results-driven financial advisory.

For me, financial success goes beyond numbers. It’s about creating stability, freedom, and the peace of mind that comes from knowing that you’re on the right path toward achieving what matters most in life.” Sophia added.

Adaptability Amidst Challenges

While challenges are an integral part of every business, we were curious to learn how Sophia overcame such phases in her business. So, we inquired, “What challenges have you faced as a business leader, and how have you overcome them?”

Sophia Rodriguez replied, “One of the biggest challenges I’ve faced as a business leader has been scaling the business while maintaining a highly personalized client experience. When I first started, I handled every client interaction myself, ensuring that each person felt heard, supported, and guided. But as the business grew, I realized I couldn’t be everywhere at once.

To overcome this, I focused on building a team of highly skilled and passionate financial advisors who share my commitment to excellence and personal service. I also developed efficient processes that allow us to scale while preserving the human touch that defines our brand. I invested in technology that streamlines operations without replacing the personalized experience clients expect.”

She further mentioned, “Expanding into international markets came with its own set of challenges, particularly when entering regions where financial literacy varies greatly. I approached this by forming strategic partnerships with local professionals who understand the specific needs of their markets. At the same time, I strengthened our digital presence, enabling us to connect with clients globally while delivering the same level of personalized service.

Through every challenge, I’ve learned that adaptability and a clear focus on our core mission—helping clients build financial security with trust and integrity—are the keys to overcoming obstacles and turning them into opportunities for growth.”

Innovation With AI

We further asked, “How do you see technology, especially AI, impacting your industry? Are there any innovative practices you’re implementing?”

Sophia Rodriguez responded, “AI is reshaping the financial advisory industry by enabling faster, more precise, and data-driven decision-making. In my practice, I integrate AI-powered tools that simulate various investment scenarios and forecast portfolio performance, allowing me to design personalized financial plans supported by real-time analytics. This ensures clients receive strategies tailored to their goals, backed by the latest financial insights.

Automation and streamlined processes are the backbone of how I manage my business. We use an advanced CRM platform that centralizes client data, tracks interactions, and helps prioritize tasks. Productivity tools keep daily operations organized, ensuring that essential processes like appointment scheduling, client onboarding, and follow-up tasks are executed efficiently. This allows me to focus on what matters most—building meaningful client relationships and delivering tailored financial advice.”

Sophia Rodriguez added, “While technology is crucial, I firmly believe that the human element in financial advising is irreplaceable. Financial planning goes far beyond numbers—it’s about understanding people’s unique stories, ambitions, and concerns. Empathy, emotional intelligence, and trust remain the foundation of every financial decision-making process.

As Matthew Lamb, CEO of Pacific Asset Management, wisely said – The alpha is in the advice. Financial advisory is about much more than managing portfolios—it’s about delivering insight, providing understanding, and creating strategies that drive meaningful and lasting change in people’s lives.

I often say – In today’s world, every business must be a digital business. This mindset pushes me to continuously adapt, integrating cutting-edge technology with personalized, human-driven advice. True financial success comes from balancing smart automation with a personal touch—helping clients not only build wealth but also experience peace of mind, knowing their financial future is in capable and caring hands.”

Envisioning The Future

Eager to learn Sophia’s perspective on the expansion of her industry, we inquired, “What are your views on the future of the industry you’re associated with?”

Sophia Rodriguez mentioned, “The future of the financial advisory industry lies at the intersection of human expertise and technological innovation. While AI, automation, and advanced analytics will streamline administrative and data-driven tasks, personalized advice based on trust, empathy, and a deep understanding of individual goals will remain irreplaceable. Financial advisory is not just about numbers—it’s about life-changing decisions that require emotional intelligence and human insight.

I believe we’re moving toward a hybrid model where financial advisors will combine cutting-edge technology with personal expertise to deliver highly customized solutions. Automation will handle repetitive tasks like data processing and compliance, allowing advisors to focus on creating tailored strategies that align with clients’ unique needs. This shift will elevate the role of financial advisors from service providers to strategic life partners.”

“Another major trend shaping the future is the growing emphasis on financial education. As more individuals realize the importance of taking control of their financial future, demand for financial literacy programs will surge. This is particularly relevant in emerging markets, where access to quality financial education has traditionally been limited.

At Sophia Rodriguez Financial Advisory, we are committed to being at the forefront of this movement, by providing accessible education through workshops, personalized advisory sessions, and online resources, empowering people to make well-informed financial decisions. We believe that education is the foundation for long-term financial success and that clients who understand their options are better equipped to achieve their life goals.

Ultimately, while technology will redefine how financial services are delivered, the need for trusted, personalized guidance will only grow stronger. The future belongs to firms that can balance innovation with human connection—those who see technology not as a replacement, but as a tool to amplify what matters most: genuine relationships built on trust and a shared vision for financial well-being.” She continued.

Message To Aspiring Professionals

Beginners in the financial advisory field will find it extremely helpful to hear from an industry expert like Sophia. So, we asked, “What advice would you give to aspiring entrepreneurs or leaders looking to make an impact in your industry?”

Sophia Rodriguez shared, “The best advice I can give is to stay fiercely committed to your vision, especially when things get tough—because they will. Entrepreneurship is a journey of highs and lows, where resilience, adaptability, and an open mind are essential. Embrace challenges as opportunities to grow, and be willing to learn from every experience, whether it brings success or failure.

In the financial advisory industry, integrity and credibility are your most valuable assets. Build relationships based on trust and transparency—your reputation is your most powerful currency. Never compromise your values for short-term gains, because long-term success is built on a foundation of honesty, consistency, and genuine care for your clients’ well-being.”

“Invest in your personal and professional development. The financial industry is constantly evolving, so continuous learning isn’t just an option—it’s a necessity. Surround yourself with a team that shares your vision, passion, and work ethic. People who believe in what you’re building will be your greatest strength.

Finally, remember that success isn’t just about financial returns—it’s about making a positive, lasting impact on the lives of others. When your work helps someone retire comfortably, fund their children’s education, or secure a home for their family, you’re doing much more than managing money—you’re transforming lives.

As I often remind myself – Build something meaningful, and success will follow.” Sophia added.

The Art Of Balance With A Growing Business

Lastly, we asked, “How do you maintain a work-life balance while managing a business?”

Sophia Rodriguez shared, “Maintaining a work-life balance while leading a growing business and managing family life has been a journey of learning, adapting, and accepting that I can’t do it all alone—and that’s okay. My son is nine years old, and my husband is a captain for an airline based in the UAE, which means we both have demanding careers with unpredictable schedules. Finding balance has required planning, clear priorities, and, above all, accepting help when needed.

One thing I’m incredibly grateful for is having support at home. We have someone who manages household tasks, which allows me to focus on my business while still being present as a mother and a wife. I’ve learned that asking for help doesn’t mean giving up control—it means creating space to be fully engaged where it matters most.

My family is my greatest motivation, and I prioritize spending quality time with them. Whether it’s being there for every school event, cheering at sports games, or sharing family dinners when my husband is home from his flights, these moments ground me and remind me why I do what I do.”

Emphasizing self-care, Sophia further added, “Self-care is also non-negotiable. I carve out time for exercise, personal development, and quiet moments for reflection. These routines keep me energized, clear-minded, and ready to tackle both business challenges and family commitments.

For me, true success isn’t just about growing a thriving business—it’s about earning the admiration and respect of my family by doing work that creates a positive impact on other people’s lives. Knowing that they see my efforts and understand that I’m building something meaningful gives me a profound sense of purpose that goes far beyond professional achievements. Having their unconditional support is invaluable, and it motivates me to keep going, even on the hardest days.

I’ve learned that balance isn’t about perfection—it’s about being intentional and embracing the reality that some seasons demand more from one side than the other. True success is creating a life where meaningful work and cherished family moments coexist, driven by purpose, passion, and love.”

Follow Sophia Rodriguez on LinkedIn or visit www.sophiarodriguezfa.com

Find Sophia Rodriguez Financial Advisory on LinkedIn and visit their website http://www.finanzasconsophia.com/

Also Read :-

Promoting Mental Well-being And Accessible Services With Openminds: Shankar Srinivas Kuchibatla

The Journey of MasterTech With Abdul Ansar: From Vision to Innovation