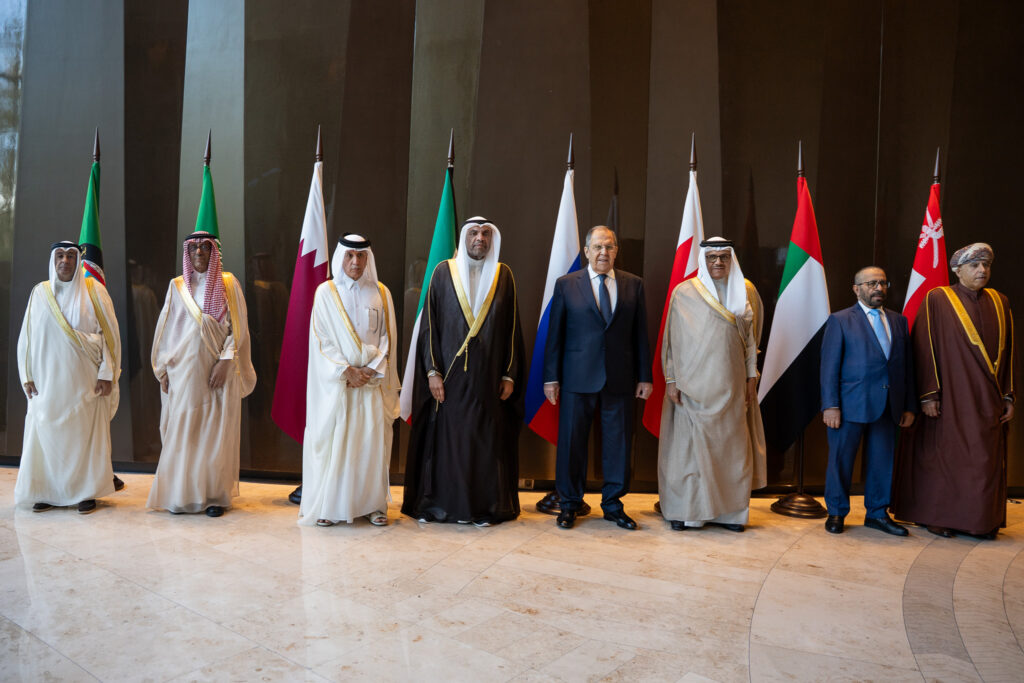

Khaled Mohamed Balama, Governor of the Central Bank of the UAE (CBUAE), participated in the 85th Meeting of the GCC Central Bank Governors Committee held in Kuwait. The meeting brought together governors from the GCC member states’ central banks and senior officials from the GCC General Secretariat.

The discussions focused on recent monetary and financial developments across the GCC and explored ways to enhance cooperation in monetary policy, financial systems, and banking services. Key topics included payment systems, financial technology, banking sector cybersecurity, international collaboration, and efforts to combat money laundering and terrorism financing.

The CBUAE also reported a 1.9% increase in gross banks’ assets, rising from Dhs4,878.3 billion in May to Dhs4,973.3 billion in June 2025. The money supply aggregates M1, M2, and M3 all experienced growth, driven by increases in currency circulation, monetary deposits, and quasi-monetary deposits. The monetary base increased by 2.8%, supported by higher reserve and current account balances, while gross credit and bank deposits also experienced growth during the period.

From Dhs 836.7 billion at the end of May 2025 to Dhs 860.0 billion at the end of June 2025, the monetary base grew by 2.8%. Reserve account gains of 6.8% and bank and OFC current accounts and overnight deposits at CBUAE of 61.2% drove the increase in the monetary base, surpassing the decreases in currency issued by 0.4% and monetary bills and Islamic certificates of deposit by 14.0%.

Also Read:

Dr. Sofica Bistriceanu’s Journey as a Multifaceted Expert

Revolutionizing IT Globally with Local Expertise: Emery Geosits as the CEO of The Global IT Alliance